August 2025

Key highlights:

- Conditions for small businesses continue to improve. The ASBFEO Small Business Pulse increased by 0.6% in August 2025 – the second consecutive quarterly increase. Over the past 12 months it has increased 0.2%.

- This increase reflects cautious optimism with a shift in small business owner focus from immediate survival concerns towards durability, growth, innovation and productivity opportunities from technology and artificial intelligence and a continued focus on cost containment and protecting long-term margins.

- Small business owners are increasingly seeking to diversify their business, particularly those in industries that have faced tough conditions for a prolonged period. These include industries that rely on discretionary spending and those that rely on favourable weather conditions.

- Challenges remain in the operating environment. There has been a shift from concern about staffing availability to costs. Concerns about regulatory requirements have increased across a wide range of areas including employer responsibilities and superannuation, insurance and business registration and licensing requirements.

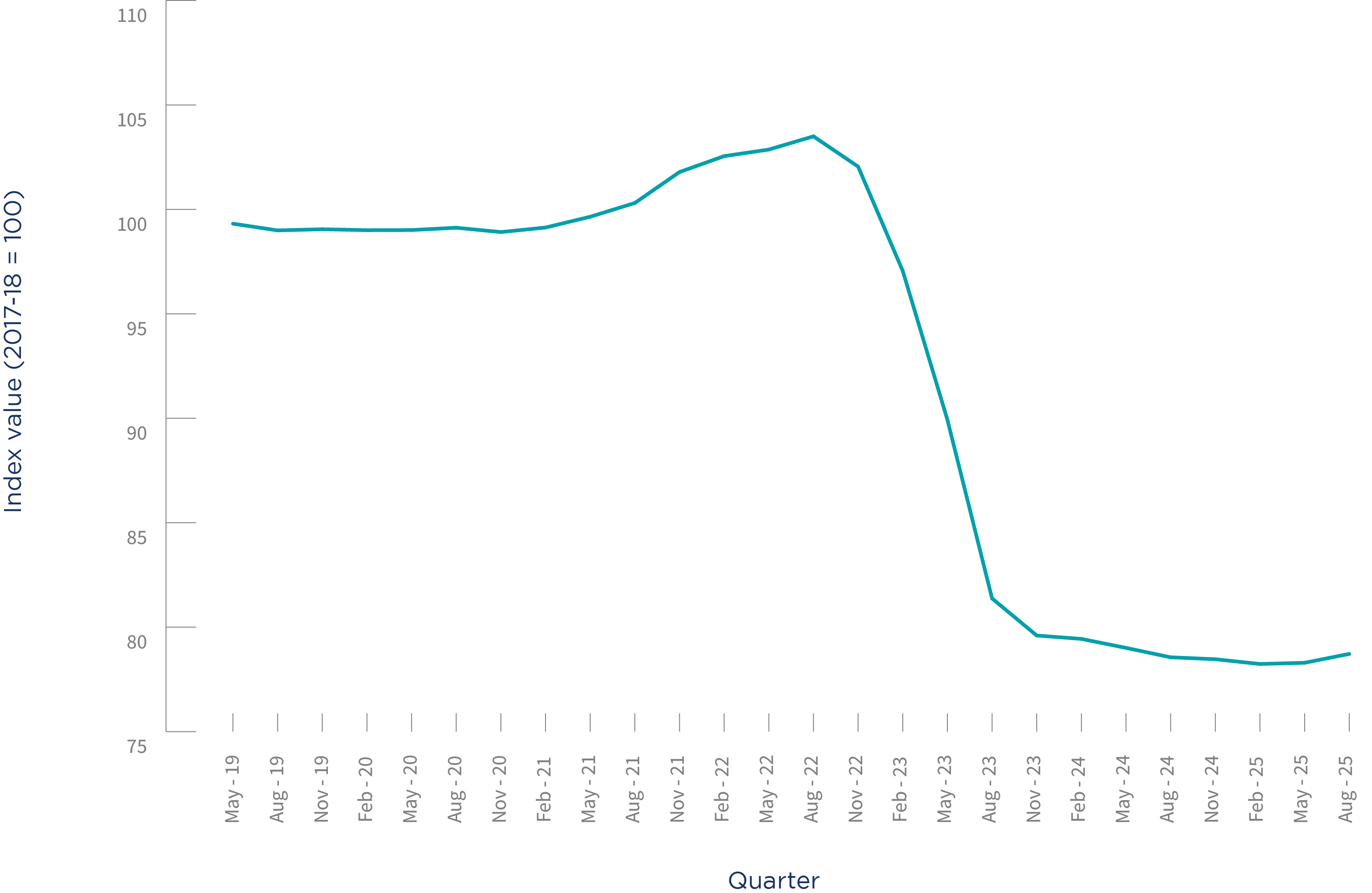

ASBFEO Small Business Pulse

Note: Scale starts at 75.0.

Source: ASBFEO, 2025

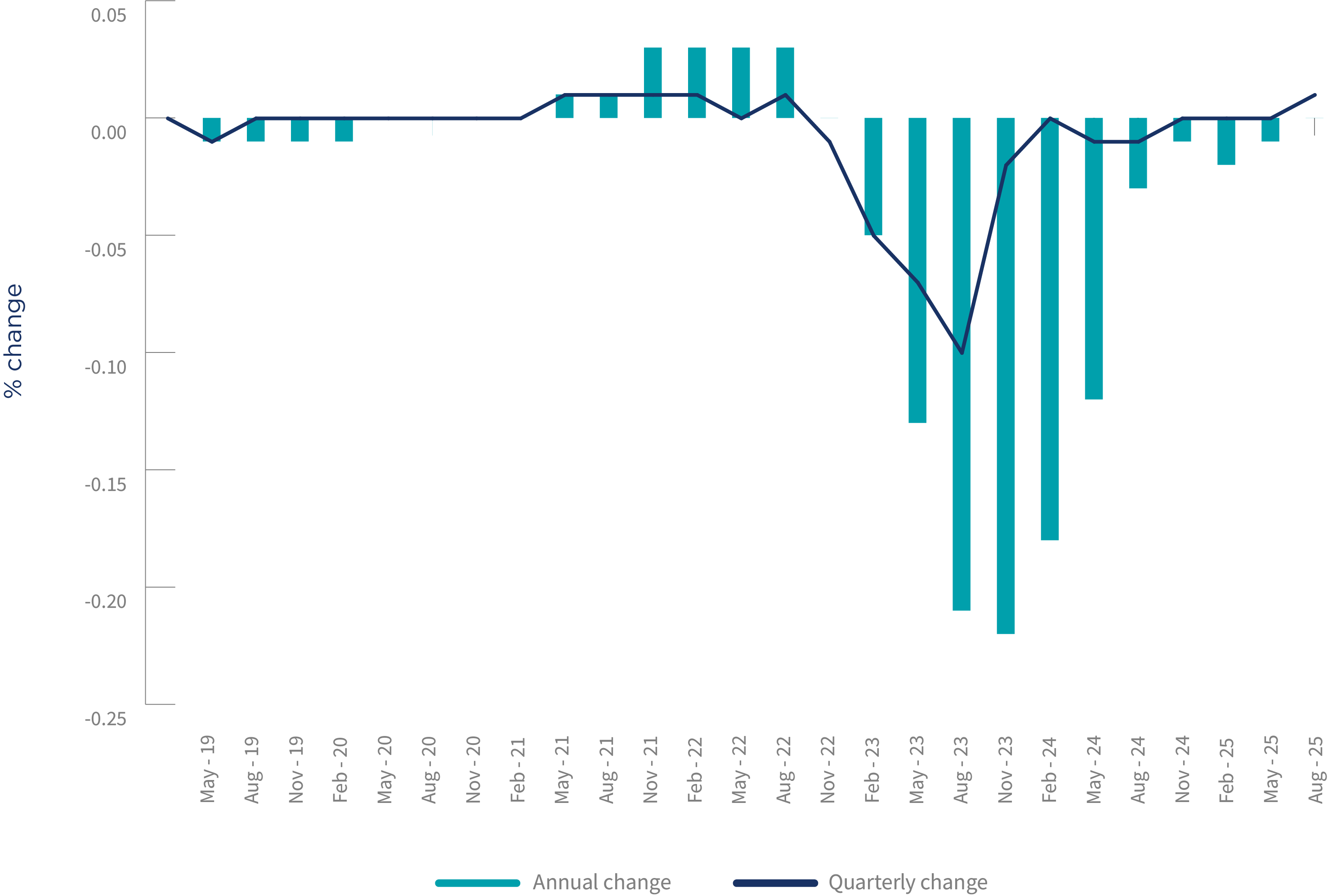

ASBFEO Small Business Pulse Changes

Note: The ASBFEO Small Business Pulse did not reflect a fall in 2020 as government support measures outweighed other economic impacts. As economic activity, including insolvencies, have returned to trend levels, the Pulse has reflected these shifts.

Source: ASBFEO, 2025

Spotlight on the last 18 months

Source: ASBFEO, 2025

The ASBFEO Small Business Pulse increased by 0.6% in August 2025 – the second consecutive quarterly increase. Over the past 12 months it has increased 0.2%.

The Australian Small Business and Family Enterprise Ombudsman, Bruce Billson, said this reflects cautious optimism with a shift towards durability, growth, innovation and productivity opportunities from technology and artificial intelligence and a continued focus on cost containment and protecting long-term margins. Business optimism is gaining strength after facing years of headwinds.

“For small and family businesses, higher interest rates not only impact their costs of financing but have profound implications for customers in terms of their spending, preferences, and confidence. The Reserve Bank of Australia’s decision to further reduce the target cash rate to 3.60% and moderating inflation pressures have supported the shift in small business owners’ focus from survival to durability and growth. This includes comparing options for financing investment in current small businesses and start-ups,” Mr Billson said.

The Small Business Pulse is a health check of objective vital signs for small business while also taking into account the ‘animal spirits’ that drive decision making.

“Small business owners are increasingly researching how technology may assist with delighting more customers and boosting productivity by streamlining administrative tasks. Queries about e‑commerce, digital and social media marketing and the opportunities artificial intelligence may provide continue to increase rapidly. Small business owners are increasingly seeking to diversify their business, particularly those in industries that have faced tough conditions for a prolonged period. These include industries that rely on discretionary spending such as retail, and those that rely on favourable weather conditions,” Mr Billson said.

“Small business owners are most interested in workshops or face-to-face meetings as the way to explore future business prospects in preference to online tools and resources.

“Small business owners are acutely aware of the broader challenges technological change can bring. Queries about using artificial intelligence to support regulatory compliance have continued to increase, along with concerns about the impact of possible regulatory interventions or policy measures aimed at safeguarding the community. Small business owners recognise the risks and are concerned about the impact for their staff. Of employers with at least ten staff, seventy per cent are concerned about technology and artificial intelligence replacing work currently performed by people[1].

“Queries about hiring staff have increased, with a shift from concern about staffing availability to costs. The complex industrial landscape is also a concern, with small businesses seeking information on employment arrangements and entitlements including changes to pay and superannuation. Small business owners are finding new ways of providing employment and opportunity in their communities. Research into employing younger workers, people with disability, and providing part-time and flexible working arrangements has increased[2].

“Concerns about regulatory requirements increased this quarter, with workplace laws, privacy duties, workers compensation and payroll tax obligations just some of many challenging areas facing small businesses. This uncertainty and complexity can constrain growth. Queries about whether sole traders can employ staff and whether small business owners can operate multiple businesses under a single business identifier have increased this quarter[3]. Small business owners continue to report that understanding insurance requirements and accessing suitable affordable insurance remains difficult.

“Sole traders continue to query tax reporting and deduction rules, while inquiries about the tax implications of ‘side hustles’ have increased, including whether to disclose ‘exploratory’ endeavours such as a one-off market stall.

“Small business owners are continuing to research options to reduce high business expenses across their operations. This ranges from researching alternative wholesale suppliers, utilities, and freight options to proactive controls such as inventory management, particularly cloud-based options. Research on finance options to ensure cash flow have increased, including invoice factoring.

“Corporate insolvencies remain relatively high, with unincorporated business insolvencies starting to rise, although remaining below pre-pandemic levels in nominal terms. Small businesses are increasingly seeking information on protections available to trade creditors in case a business that owes them money becomes insolvent. Although the volume of queries from small business owners experiencing financial difficulties has eased, the level of distress remains high. The lasting impact of natural disasters compounds these pressures for many small businesses.

“The rebuilding of business optimism and vitality isn’t marked by a single moment, but by a series of small, upward steps. That’s why we have proposed 14 Steps to ‘energise enterprise’ designed to improve the prospects of success for the nation's 2.59 million small businesses,” Mr Billson said.

You can find them here www.asbfeo.gov.au/14-steps

MEDIA CONTACT: 0448 467 178 / www.asbfeo.gov.au

Download the Small Business Pulse.

[1] Australian Survey of Social Attitudes 2024 Waves 1,2,3 and 4, accessed 25 August 2025.

[2] Department of Industry, Science and Resources Contact Centre Operational Data (June to July 2025).

[3] Department of Industry, Science and Resources Contact Centre Operational Data (June to July 2025).